Address

304 North Cardinal St.

Dorchester Center, MA 02124

Work Hours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

Medellín is the second largest city in Colombia. It houses almost 3 million people and although it is not the capital it is the most famous city in Colombia because of Pablo Escobar and the Medellín Cartel in the ’80s and ’90s. Many young people know Medellín now from the series Narcos and the new upcoming Reggaeton artists. The history of Medellín is not one of the happiest, a lot of (drug) wars and violence have taken place between the FARC, the Cartels, and the government. In 2016 a peace agreement was signed between the FARC and the government. Also, the Cartels laid their guns down, and Medellín became more peaceful and friendly. A good example is Communa 13. A neighborhood that used to have the most murders a day in the world now has risen to one of the most popular touristic places, with walls of art and artists all across the streets.

One of the reasons why many people believe Medellín is now a good place to invest in is because it is a city with one of the fastest-growing economies in the world. The investing-friendly environment for people that live outside the country makes it also very accessible for foreigners to make invest. Therefore, there are a lot of developments going on and a lot of foreign businesses are moving to Medellín.

Before the pandemic, the number of people that traveled to Medellín for tourism rose 15% on average per year. Of Course, the pandemic put it on a break, but because of the inflation rising 8% on an annual base in the USA and Europe, there were still a lot of nomads traveling around. Before the pandemic only 1/7 people worked from their laptops, now after the pandemic, it is 4/7. The expectation is therefore that a lot of western people will move from their country and go live in Medellín because when they can earn their dollars or their euros they have a way better life in Medellín.

Not only because of the money nomads or emigrants will choose Medellín, but also because the climate is very comfortable. They call it “the city of eternal spring”. The weather is always between 20-25°C (with some exceptions 15-30°C). Also depending where in the city you are. Winters are in March, April, September, and October. At this time the weather is wetter and it can be 18°C, but it also can be 28°C. It is really hard to predict but, people that always hated the winters or the short days of sunlight in some countries, now have more opportunities to move since money is not a reason to stay in the country they don’t like.

A lot of people still have an idea of Colombia or Medellín being a dangerous place and like in any other city or country, bad things happen, but in general, especially for foreigners and in touristic neighborhoods it is very safe. The local people are very helpful and welcoming, they are proud of their country and they are happy that you are interested in their country. More people are seeing this now and the world is spreading. For that reason, tourism is rising so fast.

Medellín is home to most of the famous Reggaeton singers in the world. It has a unique kind of fashion and culture which gives it its own unique DNA compared to other places in Colombia. With beautiful modern restaurants and good chefs, it makes it feel more western than other parts, which a lot of people like. It is a city that has, just like any other city, problems with traffic but there are a lot of trees, plants, and animals that in some of the neighborhoods, like El Poblado, feel more like a jungle than a city.

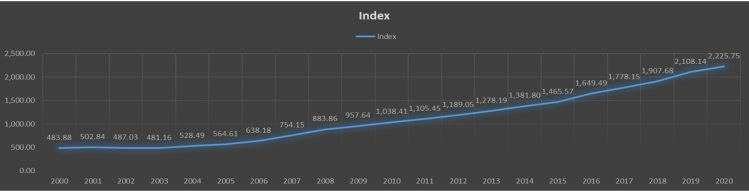

Investing is more than the characteristics of a city, you have to know numbers. As an investor, you never know what will happen in the future, but we can look at the past and the numbers in the past are really good. As you can see in the data we show here, the house price in COP never went down in the last 20 years. Why is that? In Medellín they don’t use the credit system that we have in the western world with rising and declining interest rates, it is always high, which makes it more difficult for people to buy houses, which makes it more stable.

The market in Medellín is therefore very slow, there is a low volume in buying and selling for that reason

If we take a closer look at the numbers in the graph above, we can see that it rose even faster when the market in Europe was going down, also the COP performed very well in those 4 years. So in the past, it was a really good hedge investment for people that own real estate in Europe or the USA as well.

These numbers have a reason of course. Why is Colombia performing well during hard times in Europe? It is because of the resources in the country, Oil and gold are one of the biggest resources there are in Colombia and these prices always seem to rise in times of a recession, which makes Colombia more stable than other countries. Also because of the credit system they have, there is never a big pullback, because there is less instability and more people can afford to buy a house and can have more patience with selling.

One of the most interesting investments is daily rentals. The government is regulating tourism that comes through Airbnb by only having several buildings that are allowed to rent rooms per day. These rules they have so that tourists don’t come to stay next to locals, they protect the quality of living for the locals in this way, cause tourists tend to like to have more parties and create more noise at times local people need to go to work.

The average price per m2 is a little bit higher, but the return on investment (ROI) on an annual basis can also be higher. The longer-term value increase, in dollars, is also more secure. There is a risk of a COP declining compared to USD and EUR, but these buildings are more investor buildings and investors only look at annual ROI. So if the ROI rises, the price of the apartment, in dollars will rise as well. There is also a low supply of these kinds of buildings. As we talked about before, tourism is rising very fast and therefore the demand can be outpacing the supply which increases the average price of rent per night, which will increase the ROI and also increase the prices of the apartments.

Daily rental buildings, have more services, think of a swimming pool, restaurant, gym, or tour service. It is more like a hotel. If you are searching for a building to invest in it is important that you check the quality of these services, since they will make a huge difference in the experience of your future guest.

Having a rental property on Airbnb is more like a business, it is less passive than a monthly rental and it needs more attention. You need to furnish and manage your apartment for your customers, think of cleaning, check-in, check out, something missing or got broken, you need to solve it, therefore if you won’t be staying in Medellín yourself, you need to find a manager. This can be difficult and managers can charge anywhere between 10-20% of your profits, a manager that takes responsibility for your apartment is really important. Eventually, that will lead to better reviews, which will lead to better occupancy, which will lead to higher prices, etc…

Unless you have the time and you love decorating apartments yourself, it is easier to find a decorator, most investors do this. Decorating a house takes time and a lot of things can go wrong or are later than expected. It is also good that you know how to make your house attractive on Airbnb so you will stand out in other publications. Making an apartment listing ready can take anywhere between 1 and 2 months. Sometimes you can buy an apartment, with furniture, then this whole process will be much easier.

Monthly rentals in Medellín can also be good. You can have the option to rent it with or without furniture, the best customers will come if you rent it with furniture and it needs less attention since there is only one customer every month, at most. Since this year it is allowed to put monthly rentals on Airbnb, which makes it easier to find foreign customers. The number of nomads are increasing and they love to stay at least one month in a place to reduce costs and because they need to work as well, they don’t like moving too often.

A daily rental is something they don’t prefer because these apartments usually are more expensive, although there are a lot that earn enough, they don’t care cause they want to have the amenities that are in daily rental buildings such as a swimming pool, good restaurant, co-working space, etc. The monthly rentals are mostly more basic, they can have a pool or a gym but it is not common. There is also a lot more supply in the monthly rentals which can reduce the increase of the value of the apartment in the long term.

Land development is one of the most interesting investments in terms of ROI there is at this moment, also the most difficult one. What you do is, for example, buy a big piece of land (50.000 m2) and then divide it, build a road, and make it accessible for people to build a house on it. You can also develop your building or build complete houses before you sell them, the more you develop the higher the profits will be.

The important thing is that you find someone that helps you with the legal papers. Most of the time the permits that a piece of land got, (how many lands you can divide, how many m2 minima per house, commercial purpose, etc) are already known, therefore it is really important to know what you can do with it and have the legal confirmation before you buy it.

The best pieces of land are found just outside the city in the east part, areas like Llano Grande, el Retiro, Envigado, and Rionegro are all areas where this kind of business is a real success. Since the pandemic, a lot of rich people moved outside the city. El Retiro and Llano Grande are known to be the Beverly Hills of Medellín and are one of the most expensive areas of the country.

But there are also opportunities in the north, where they just built a new road that reduced the travel time from 3-5 hours to 1-2 hours. After the road is finished there is a lot of development going on there as well. Nature is amazing in that area and where the east is a little bit colder because it is higher, the north is a little bit warmer, because it is lower.

When you make your decision and you want to buy an apartment it is really easy. Make sure that you find a good lawyer that check the paperwork of the apartment and that it is really from the owner who says it is.

Then the Promesa de Compraventa will be realized, this is a contract between the buyer and the seller. This contract says what the buyer is buying, what the buyer will pay before a certain date, and when the seller will give the paperwork to the buyer to transfer it on his name at the notary. Check the Promesa de Compraventa on names and passport numbers, sometimes there are some mistakes, so make sure you have an agent as well that double checks everything, but don’t forget that you are responsible.

To make this document legal you go to a notary to sign it. After signing you need to pay directly to the seller, there is a lot of information to be found on the internet (that you need to have a bank account or get the money in the country), but that is untrue. You can pay directly to the seller. Keep in mind that deals are done in COP so the price in USD/EUR can change a little bit when time pass. When you do the payment there is a possibility that the bank of the seller in Colombia wants an explanation of where the money comes from, so you need to send translated documents from your bank and your income stats to verify that your money is legal.

Then, when the payment is done you will go to the notary again to sign Las Escrituras, this is the paperwork for the apartment you are buying. This contract says that you have paid for the apartment and the apartment is now yours, now the notaria will change the paperwork on your name. They say it will take one month but experience tells us it will take at least 2 to 4 months. At this time the apartment is already yours and nobody except you has the right to rent it out or sell it.

If you want to use finance for your purpose it is recommended you make sure the bank already has put the money in your account before you make a deal. When the promise is signed and you can’t fulfill the payment, there is a fine between 5-10% of the purpose. Also when you make the deal but there is a lot of time between the payment, there is a risk, because the deal is made in COP, the difference in price in USD/EUR can be quite significant.

When you already have the money you will have another advantage and that is time. People like to give more discounts if they know the money will be in their account next week. The market is slow, normally it takes between 2 or 3 months before an apartment is sold, so when people need the money quickly, they will give discounts sometimes up to 10-15%, in pesos.

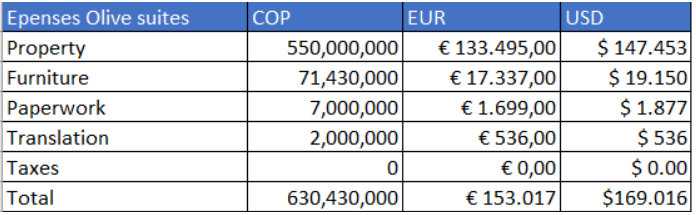

This is an example of all the costs that an apartment can have. This is an example of a new building where no taxes have to be paid yet. Property tax usually is around 1000 dollars a year in this kind of price range. The prices in euros or dollars can change over time because of the rate of the peso. Therefore your investment should be a long-term investment only and the main focus should be the cash flow you are getting. Flipping houses is not recommendable.

The property cost speaks for itself, this is eventually the deal you made with the seller.

The furniture cost can fluctuate sometimes, in this apartment it was needed to install a boiler for warm water and an extractor hood. Also, the buyer wanted a fully designed apartment with some extra features that made it more expensive than the average.

Paperwork is made once the seller has all the documents ready. Seller and buyer will go to a Notaria to sign the paperwork and to pay the fees for the process itself.

Fees: i. Paperwork fee: 0.54% of the total value of the property (this is divided between buyer and seller)

iii. New paperwork subscription: 1.67% of the total (this is paid by the buyer)

The translation is not always needed but for a quick transaction, it is advised to have the translated documents of your income statements and receipts of your bank accounts from the last 6 months. This price can also be more expensive when you work as freelance or have your own company, because then there are more documents that need to be translated like ownership and contracts.This is an example of a new

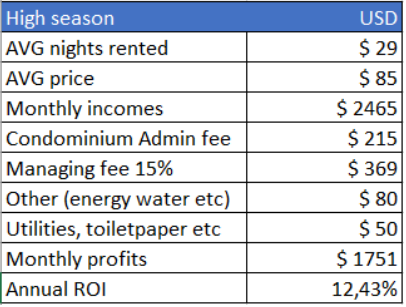

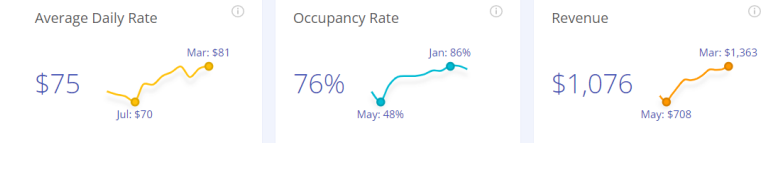

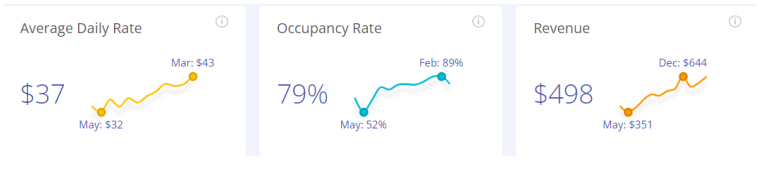

This would be a nice goal to work too. Something that also depends on how you manage your apartment, where it is located, and how you design it. There were apartments that even during the pandemic had an occupancy of 80-90%. So if you stand out people will always find you and you make a good return on your investment.

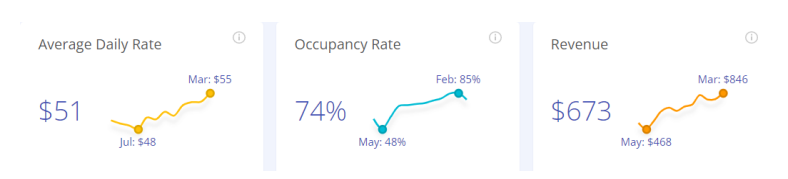

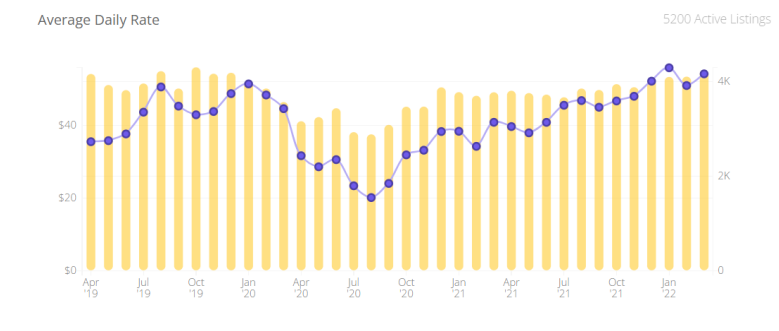

As we can see all the numbers are rising, of course, we just came out of a pandemic, which drove the stats a lot lower, so it is easy to rise from there, but before the pandemic the prices were rising 10% a year and at this moment we are above these prices again and there is no reason why it would not continue the trend of steady growth

Every investment has its risks. We must not forget the history that Colombia has gone through. Although it doesn’t look like it will happen again and the country is growing and developing a lot, you should be well looking to protect your risk while investing. If you take money from a (private) bank and you need your monthly income to pay for your mortgage, it could be a little too risky. If your income from your job or business alone is sufficient to pay for the cost, you have a lot of savings or you already have a real estate portfolio may be in your own country or already diversified in other countries and you like to diversify more, it could be a strategically smart step to take. All these things are different for every individual and every person should do their due diligence in whether or not they are willing and able to take a risk.

Then there is another risk and that is some people in Colombia try to take advantage of foreigners. You must have somebody that knows the market very well and is trustable to advise you with your purchase

So putting all the advantages and disadvantages in line, Medellín is a good place to invest in. All you need to do is, find the right people or find someone that finds the right people for you, so you will get some good deals that bring a good cash flow and will help you diversify your portfolio. Like billionaire Ray Dalio said, it is really important that you be well diversified in different asset classes, as in different countries.